simulate

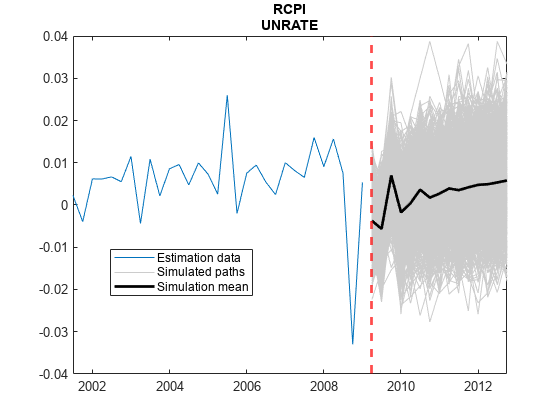

Monte Carlo simulation of vector autoregression (VAR) model

Syntax

Description

Conditional and Unconditional Simulation for Numeric Arrays

Y = simulate(Mdl,numobs,Name=Value)simulate returns numeric arrays when all optional

input data are numeric arrays. For example,

simulate(Mdl,100,NumPaths=1000,Y0=PS) returns a numeric

array of 1000, 100-period simulated response paths from

Mdl and specifies the numeric array of presample

response data PS.

To produce a conditional simulation, specify response data in the simulation

horizon by using the YF name-value argument.

Unconditional Simulation for Tables and Timetables

Tbl = simulate(Mdl,numobs,Presample=Presample)Tbl containing the random

multivariate response and innovations variables, which results from the

unconditional simulation of the response series in the model

Mdl. simulate uses the table or

timetable of presample data Presample to initialize the

response series. (since R2022b)

simulate selects the variables in

Mdl.SeriesNames to simulate, or it selects all variables

in Presample. To select different response variables in

Tbl to simulate, use the

PresampleResponseVariables name-value argument.

Tbl = simulate(Mdl,numobs,Presample=Presample,Name=Value)simulate(Mdl,100,Presample=PSTbl,PresampleResponseVariables=["GDP"

"CPI"]) returns a timetable of variables containing 100-period

simulated response and innovations series from Mdl,

initialized by the data in the GDP and CPI

variables of the timetable of presample data in PSTbl. (since R2022b)

Conditional Simulation for Tables and Timetables

Tbl = simulate(Mdl,numobs,InSample=InSample,ResponseVariables=ResponseVariables)Tbl containing the random

multivariate response and innovations variables, which results from the

conditional simulation of the response series in the model

Mdl. InSample is a table or

timetable of response or predictor data in the simulation horizon that

simulate uses to perform the conditional simulation

and ResponseVariables specifies the response variables in

InSample. (since R2022b)

Tbl = simulate(___,Name=Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

Algorithms

Suppose Y0 and YF are the presample and future

response data specified by the numeric data inputs in Y0 and

YF or the selected variables from the input tables or

timetables Presample and InSample. Similarly,

suppose E contains the simulated model innovations as returned in the

numeric array E or the table or timetable

Tbl.

simulateperforms conditional simulation using this process for all pagesk= 1,...,numpathsand for each timet= 1,...,numobs.simulateinfers (or inverse filters) the model innovations for all response variables (E(from the known future responses (t,:,k)YF(). Int,:,k)E,simulatemimics the pattern ofNaNvalues that appears inYF.For the missing elements of

Eat timet,simulateperforms these steps.Draw

Z1, the random, standard Gaussian distribution disturbances conditional on the known elements ofE.Scale

Z1by the lower triangular Cholesky factor of the conditional covariance matrix. That is,Z2=L*Z1, whereL=chol(C,"lower")andCis the covariance of the conditional Gaussian distribution.Impute

Z2in place of the corresponding missing values inE.

For the missing values in

YF,simulatefilters the corresponding random innovations through the modelMdl.

simulateuses this process to determine the time origin t0 of models that include linear time trends.If you do not specify

Y0, then t0 = 0.Otherwise,

simulatesets t0 tosize(Y0,1)–Mdl.P. Therefore, the times in the trend component are t = t0 + 1, t0 + 2,..., t0 +numobs. This convention is consistent with the default behavior of model estimation in whichestimateremoves the firstMdl.Presponses, reducing the effective sample size. Althoughsimulateexplicitly uses the firstMdl.Ppresample responses inY0to initialize the model, the total number of observations inY0(excluding any missing values) determines t0.

References

[1] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[2] Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press, 1995.

[3] Juselius, K. The Cointegrated VAR Model. Oxford: Oxford University Press, 2006.

[4] Lütkepohl, H. New Introduction to Multiple Time Series Analysis. Berlin: Springer, 2005.