estimatePortMoments

Estimate moments of portfolio returns for Portfolio object

Description

[

estimate moments of portfolio returns for a prsk,pret]

= estimatePortMoments(obj,pwgt)Portfolio object.

For details on the workflow, see Portfolio Object Workflow.

The estimate of port moments is specific to mean-variance portfolio optimization and computes the mean and standard deviation (which is the square-root of variance) of portfolio returns.

Examples

Given portfolio p, use the estimatePortMoments function to show the range of risks and returns for efficient portfolios.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

p = Portfolio;

p = setAssetMoments(p, m, C);

p = setDefaultConstraints(p);

pwgt = estimateFrontierLimits(p);

[prsk, pret] = estimatePortMoments(p, pwgt);

disp([prsk, pret]); 0.0769 0.0590

0.3500 0.1800

Create a Portfolio object for three assets.

AssetMean = [ 0.0101110; 0.0043532; 0.0137058 ];

AssetCovar = [ 0.00324625 0.00022983 0.00420395;

0.00022983 0.00049937 0.00019247;

0.00420395 0.00019247 0.00764097 ];

p = Portfolio('AssetMean', AssetMean, 'AssetCovar', AssetCovar);

p = setDefaultConstraints(p); Use setBounds with semi-continuous constraints to set xi=0 or 0.02<=xi<=0.5 for all i=1,...NumAssets.

p = setBounds(p, 0.02, 0.5,'BoundType', 'Conditional', 'NumAssets', 3);

When working with a Portfolio object, the setMinMaxNumAssets function enables you to set up cardinality constraints for a long-only portfolio. This sets the cardinality constraints for the Portfolio object, where the total number of allocated assets satisfying the nonzero semi-continuous constraints are between MinNumAssets and MaxNumAssets. By setting MinNumAssets=MaxNumAssets=2, only two of the three assets are invested in the portfolio.

p = setMinMaxNumAssets(p, 2, 2);

Use estimatePortMoments to estimate moments of portfolio returns for a Portfolio object.

pwgt = estimateFrontierLimits(p); [prsk, pret] = estimatePortMoments(p, pwgt)

prsk = 2×1

0.0324

0.0695

pret = 2×1

0.0072

0.0119

The estimatePortMoments function uses the MINLP solver to solve this problem. Use the setSolverMINLP function to configure the SolverType and options.

p.solverOptionsMINLP

ans = struct with fields:

MaxIterations: 1000

AbsoluteGapTolerance: 1.0000e-07

RelativeGapTolerance: 1.0000e-05

NonlinearScalingFactor: 1000

ObjectiveScalingFactor: 1000

Display: 'off'

CutGeneration: 'basic'

MaxIterationsInactiveCut: 30

ActiveCutTolerance: 1.0000e-07

IntMainSolverOptions: [1×1 optim.options.Intlinprog]

NumIterationsEarlyIntegerConvergence: 30

ExtendedFormulation: 0

NumInnerCuts: 10

NumInitialOuterCuts: 10

The Portfolio object is able to find an efficient portfolio with respect to a specified target risk.

Load Portfolio

Load a vector of expected returns and a covariance matrix for 30 stocks.

load StockStatsCreate Portfolio Object with Default Constraints

The default constraints for a Portfolio object are that it is a long-only portfolio and that it is 100% invested. Many other constraint types are possible.

P = Portfolio('mean',expRet,'covar',expCov); P = setDefaultConstraints(P);

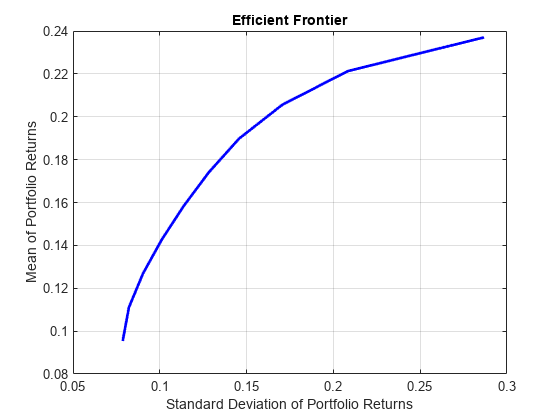

Plot Full Efficient Frontier

Use the plotFrontier function with the Portfolio object to visualize the full frontier. Other functions exist that allow you to probe into particular portfolios along the frontier.

P.plotFrontier

Capture Upper and Lower Bounds of Portfolio Risks and Returns

It is useful to know what are the upper and lower limits of the portfolio moments along the efficient frontier. This information allows you to determine what are feasible targets. Use the estimateFrontierLimits function with the Portfolio object to identify the weights at these extremes. Then you can use the estimatePortMoments function Portfolio object to find the limiting moments.

P_Weights1 = P.estimateFrontierLimits; [P_risklimits, P_returnlimits] = P.estimatePortMoments(P_Weights1)

P_risklimits = 2×1

0.0786

0.2868

P_returnlimits = 2×1

0.0954

0.2370

Estimate Efficient Portfolio with Target Return

Select a target return for the portfolio somewhere in the feasible region. You can estimate its makeup with estimateFrontierByRisk and then confirm its moments using estimatePortMoments.

targetReturn = 0.15; P_Weights2 = P.estimateFrontierByReturn(targetReturn); [P_risk2, P_return2] = P.estimatePortMoments(P_Weights2)

P_risk2 = 0.1068

P_return2 = 0.1500

The return matches the targetReturn value and the risk is in agreement with the efficient frontier plot.

Estimate Efficient Portfolio with Target Risk

The Portfolio object is able to find an efficient portfolio with a specified target risk.

targetRisk = 0.2; P_Weights3 = P.estimateFrontierByRisk(targetRisk); [P_risk3, P_return3] = P.estimatePortMoments(P_Weights3)

P_risk3 = 0.2000

P_return3 = 0.2182

Another useful feature of the estimateFrontierByReturn and estimateFrontierByRisk functions is what happens if you specify an infeasible (too high or too low) target. In this case, these functions provide a warning message to suggest the best solution.

Input Arguments

Object for portfolio, specified using a Portfolio

object. For more information on creating a portfolio object, see Portfolio.

Data Types: object

Collection of portfolios, specified as a

NumAssets-by-NumPorts matrix where

NumAssets is the number of assets in the universe and

NumPorts is the number of portfolios in the

collection of portfolios.

Data Types: double

Output Arguments

Estimates for standard deviations of portfolio returns for each portfolio

in pwgt, returned as a NumPorts

vector.

prsk is returned for a Portfolio

input object (obj). If the asset returns provided to

the Portfolio object are daily returns, then the output

(prsk) for the standard deviation of the portfolio(s)

is also in daily terms.

More About

The moments of portfolio returns are statistical measures that provide insights into the characteristics of the return distribution of an investment portfolio.

The moments of portfolio returns provide information on:

The variance and standard deviation to help investors gauge the risk associated with their portfolio.

A mean return that provides a benchmark for evaluating portfolio performance.

Tips

You can also use dot notation to estimate the moments of portfolio returns.

[prsk, pret] = obj.estimatePortMoments(pwgt);

Version History

Introduced in R2011a

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)